Impact of Interest Rate Changes: Federal Reserve Interest Rates

Federal reserve interest rates – Interest rate changes are a powerful tool used by central banks to influence economic activity. By adjusting the cost of borrowing, central banks can stimulate or slow down economic growth, control inflation, and stabilize unemployment.

The Federal Reserve’s recent interest rate hikes have sent shockwaves through global markets. While the move was widely anticipated, its impact on emerging economies like méxico brasil is still being debated. Some analysts believe that the rate hikes will lead to a slowdown in economic growth in these countries, while others argue that the impact will be minimal.

The Federal Reserve’s next meeting is scheduled for September, and the outcome of that meeting could have a significant impact on the global economy.

Interest Rate Increases

When interest rates are increased, the cost of borrowing becomes more expensive. This discourages businesses from investing and consumers from spending, which can slow down economic growth. Interest rate increases are often used to combat inflation, as they make it more expensive for businesses to raise prices.

The Federal Reserve’s recent interest rate hikes have had a ripple effect on global markets. In particular, the US dollar has strengthened against the Brazilian real. This has led to a decline in the value of Brazilian assets, making them more attractive to foreign investors.

As a result, the Brazilian stock market has outperformed the US market in recent months. For more on this topic, see USA vs Brazil. The Federal Reserve’s decision to raise interest rates is likely to continue to have a significant impact on the global economy.

Interest Rate Cuts

When interest rates are cut, the cost of borrowing becomes cheaper. This encourages businesses to invest and consumers to spend, which can stimulate economic growth. Interest rate cuts are often used to combat unemployment, as they make it easier for businesses to hire new workers.

Examples

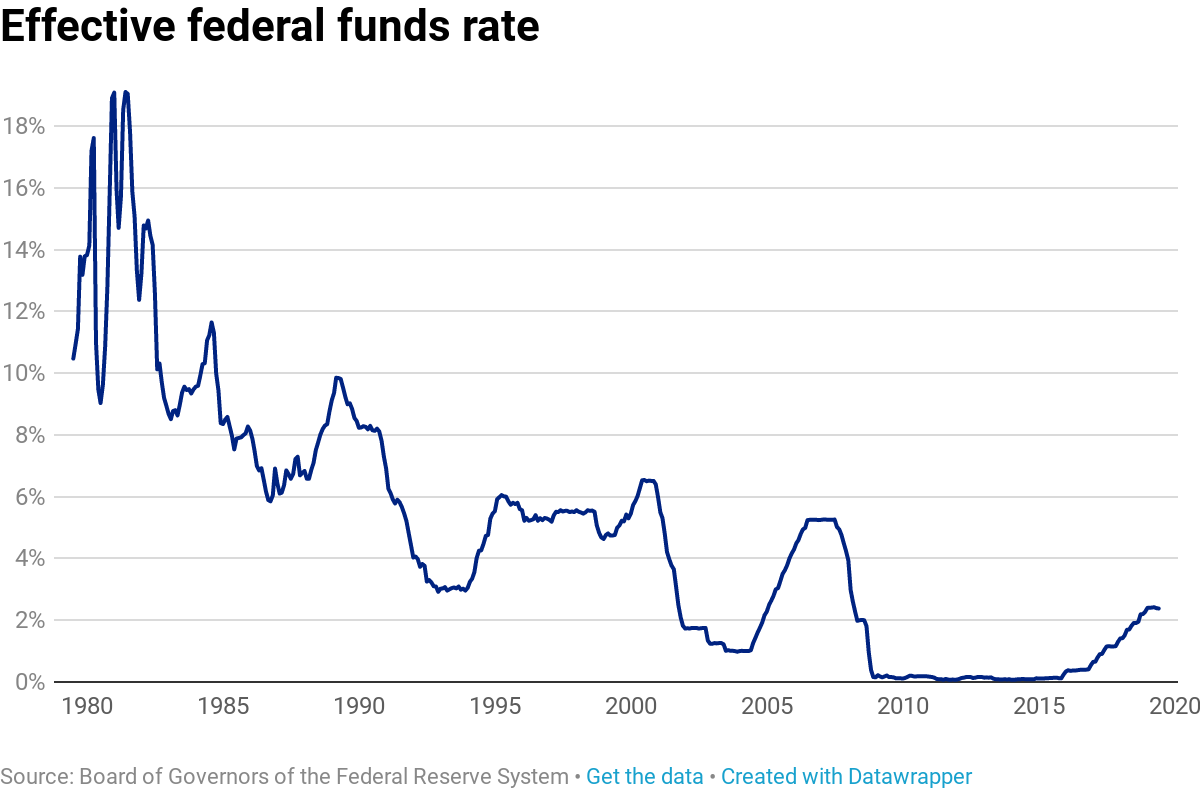

There are many examples of how interest rate changes have influenced past economic cycles. In the United States, for example, the Federal Reserve raised interest rates in 2004 to combat inflation. This led to a slowdown in economic growth and a decline in inflation.

In contrast, the Federal Reserve cut interest rates in 2008 to combat the Great Recession. This led to a recovery in economic growth and a decline in unemployment.

Factors Influencing Interest Rate Decisions

The Federal Reserve (Fed) considers a range of economic indicators when setting interest rates. These indicators provide insights into the overall health of the economy and help the Fed make informed decisions that support its mandate of price stability and maximum employment.

Inflation

Inflation, or the rate of increase in prices, is a key factor that influences the Fed’s interest rate decisions. High inflation erodes the value of money and can lead to economic instability. The Fed aims to keep inflation low and stable, typically around 2%, to maintain price stability and preserve the purchasing power of the dollar.

Unemployment

Unemployment, or the percentage of the labor force that is actively seeking work, is another important indicator that the Fed considers. High unemployment can signal a weak economy and reduced demand for goods and services. The Fed often lowers interest rates to stimulate economic growth and reduce unemployment, but it must balance this against the potential for higher inflation.

GDP Growth

Gross domestic product (GDP) measures the total value of goods and services produced in the economy. GDP growth is a key indicator of economic health and potential. The Fed aims to promote sustainable GDP growth, but it must also consider the potential impact of rapid growth on inflation and financial stability.

Global Economic Conditions

The Fed also considers global economic conditions when setting interest rates. Economic events in other countries can affect the U.S. economy through trade, investment, and financial markets. The Fed monitors global economic data and coordinates with other central banks to ensure that its interest rate decisions are aligned with global economic conditions.

Communication and Transparency

The Federal Reserve has a well-defined communication strategy for announcing interest rate changes. This strategy is designed to provide the public with clear and timely information about the Fed’s monetary policy decisions. The Fed typically announces its interest rate decisions at 2:00 p.m. Eastern Time on eight regularly scheduled meeting dates throughout the year. The announcement is made in a press release that includes a statement from the Federal Open Market Committee (FOMC), which is the Fed’s policy-making body.

The FOMC statement typically provides an explanation of the Fed’s decision and the reasons behind it. The statement also includes a summary of the economic conditions that the Fed considered in making its decision. The Fed also holds press conferences following its meetings, which provide an opportunity for reporters to ask questions about the Fed’s decision and its implications for the economy.

Transparency, Federal reserve interest rates

Transparency is an important part of the Fed’s communication strategy. The Fed believes that providing the public with clear and timely information about its monetary policy decisions helps to promote understanding and confidence in the Fed. The Fed also believes that transparency helps to ensure that its decisions are made in a fair and impartial manner.

Market Expectations

The Fed’s communication strategy has a significant impact on market expectations and economic behavior. When the Fed announces an interest rate change, it is often followed by a change in the prices of stocks, bonds, and other financial assets. The Fed’s communication strategy also affects the behavior of businesses and consumers. For example, if the Fed signals that it is likely to raise interest rates in the future, businesses may be less likely to invest and consumers may be less likely to spend.

The Federal Reserve’s recent interest rate hikes have had a ripple effect on the global economy, but one area that has remained relatively unaffected is the world of world cup qualifiers. With teams from around the world vying for a spot in the prestigious tournament, the excitement and intensity on the pitch have not been dampened by economic headwinds.

Despite the financial uncertainty, the passion for the beautiful game continues to burn brightly, uniting fans and players alike.

Federal Reserve interest rates have a significant impact on the economy, and their recent increase has been a topic of much discussion. While the impact on USA soccer may not be immediately apparent, it is important to consider how economic conditions can affect the performance of sports teams.

With higher interest rates, businesses and consumers may have less disposable income, which could lead to a decrease in attendance at sporting events.

The Federal Reserve’s recent interest rate hike has sparked a debate about its potential impact on emerging markets like Brazil and Mexico. Brazil and Mexico have been experiencing strong economic growth in recent years, but the interest rate hike could slow down their momentum.

The central banks of both countries are expected to raise interest rates in response to the Fed’s move, which could make it more expensive for businesses to borrow money and invest. As a result, the economic growth of Brazil and Mexico could be dampened in the coming months.